FAQS-Professional Liability Insurance

Once AIC-ON has processed your candidate membership, you will be provided a welcome email with information regarding next steps including instructions on purchasing liability insurance.

Fee vs. Non-Fee Classification – Which are you?

It is important that you understand the distinction as it may affect whether you have proper insurance coverage.

Fee

If you prepare or assist in the preparation of an appraisal report, (regardless of whether you sign the report) and the report is provided to a third party that relies upon it, then you should consider yourself a “Fee” Member.

Non-Fee

If you are not currently working as an appraiser or

you prepare or assist in the preparation of an appraisal report and the report is used internally and is NOT provided to a third party, then you should consider yourself a “Non-Fee” Member. (e.g. you are employed by a municipality and prepare reports for internal use only)

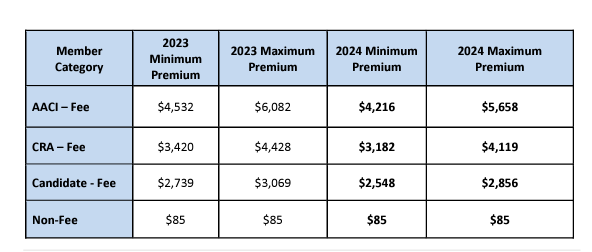

Every year AIC provides a communication regarding the breakdown for Insurance costs and rationale. Please see the cost range for the 2024 insurance with a 2023 comparable:

Professional Liability Insurance must be purchased immediately upon becoming a Candidate member. This coverage is mandatory for all Candidate Members– whether you are actively working in the industry or not.

Members can pro-rate their payments OR pay in full for the year.

It is mandatory for all members to purchase insurance through AIC’s Professional Liability Insurance program.

Working in the best interest of our members, the AIC’s Insurance program exists to:

• create a stable guaranteed source of insurance for members;

• ensure adequate coverage can be obtained under reasonable terms;

• provide dedicated, professional insurance services to members at a reasonable cost, directly related to the claims experience of the profession;

• minimize administrative “red tape

The insurance cycle runs from January 1st until December 31st.

CONTACTS FOR EXISTING AIC MEMBERS

NOTE: To expedite service, please indicate to the point of contact that you are an AIC Member.

| Legal Advice from Trisura: | • Call the helpline at 1(866) 945-5207. • Have your policy number ready to confirm that you are a Trisura policyholder. • They are available 8 a.m. to midnight (local time), seven days per week. • In emergency situations, a lawyer will be made available regardless of the time of day. • You can speak directly to a legal representative or schedule the most convenient time for a lawyer to call you back |

| Insurance Program Portal Log-in Issues: | If you have difficulties accessing the AIC Insurance Program web portal, email or call 1-855-619-8AIC (8242) for assistance. Please have your login email and password ready. |

| For Technical Issues with the Portal, including difficulty opening pages, and problems making online payments: | Trisura|Email: |

| Claims or Potential Claims: | Katja Kim | Verity Claims Management | (647) 884-5065 | Email: |

| Insurance, Coverage & Other Matters: | HUB International | 595 Bay Street, Suite 900 Toronto, Ontario, M5G 2E3 | Phone: 1 (855) 619-8242 | Email: |