Valuation – International Challenges and Opportunities in Developing Countries

Canadian Property Valuation Magazine

Search the Library Online

By Bruce Turner, AACI, P. App., Courtenay, BC

Introduction

This article explores the importance of property valuation as a function of a modern land administration system (LAS), with particular focus on its relevance in helping address some of the challenges faced by developing countries that need infrastructure for fair and equitable taxation, better land use control, efficient property and credit markets and access to international capital markets. Such infrastructure, including property valuation, is essential in formalized property markets to encourage domestic as well as foreign direct investment in land, which is necessary to economic growth and wealth creation.

In the past two decades, forces such as globalization, securitization of real estate, growth in capital markets, climate change, changing demographics and enabling technology continue to drive the need for sophisticated national concepts in integrated land management. At one end of the spectrum, in North America and Europe, elements of land administration systems (including property valuation) are being integrated into seamless business lines, where clients have focused access to a suite of property-related services that inform their decisions in changing global property markets. Real estate service providers are shifting their business models through strategic thinking and business planning, force field analysis, re-engineered business processes for cross-functional operations and improved service delivery, accompanied by development of international professional standards.

At the other end, developing countries in South-East Asia and Africa are receiving advice through internationally funded projects about how to establish the basic operations of a land administration system and to introduce the fundamentals for functional property markets. Of the 227 world nations, approximately 40 can claim to have formal comprehensive property markets (Williamson and Wallace, 2007).

Emerging property markets – including examples like Thailand and India – represent investor-driven demand for valuation services. A less well represented need for valuation information to support decision-making lies in the demand by multi-nationals and developed countries for large land tracts in developing and least-developed countries in Africa, Latin America and South East Asia. Demand that has recently escalated due to factors such as climate change, climate obligations, political support for agro-fuels, and trade liberalization – factors which were exacerbated by 2007-08 food crises and the financial crisis of 2008. Although information is scanty on individual transactions, their scope is evident in the single deals which have been as large as 1.3 million hectaresi. Such land concession decisions, made in the absence of functional land administration systems (providing for secure land tenure, land use control and land valuation information) can increase conflict and make long-term impact evaluation difficult.

Foreign direct investment (FDI) in landii has received little attention in past. However, according to a recent German study, the magnitude and relevance of FDI in land is growing rapidly. And while FDI in land in developing countries brings many benefits to developing countries, the commercial pressures on land are worldwide and not always positive – particularly where policy- and decision-makers do not have the benefit of information from efficient LAS, which exist in formalized property markets1.

Valuation professionals can contribute significantly to fill the decision-making information vacuum in developing countries, and consequently benefit their own professional development.

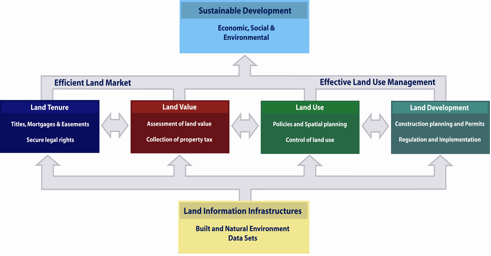

Valuation: a pillar in land administration

A land administration framework helps provide valuation experts with context for how their services relate to other professionals in aiding policy- and decision-makers to achieve multi-dimensional goals in sustainable development (i.e., economic, social, environmental and cultural). As Figure 1 indicates, valuation is an essential pillar of the modern land administration system whether one is considering property markets in developed or developing countries. Land administration systems (LAS) provide the framework for policy implementation and support information transparency necessary to efficient land markets by drawing together the four land administration functions of land tenure, land value, land use and land development2. Professional appraisers should understand how these functions are inter-related and may even take them for granted when working in mature property markets that are prevalent in developed countries. However, it is important to recognize the paradigm shifts that are occurring in modern land administration systems in developed countries, and equally important to consider how valuation contributes to the land administration systems that are being created in developing countries. The latter is our focus in this article, as we consider the need for shifting from informal to formal property markets in developing countries.

FIGURE 1: Global view of a modern land administration system3

Baseline: moving from informal to formal property markets in developing countries

There is evidence of significant correlation between development of effective land administration systems and the transition from informal to formal property markets4. Before considering the interaction between land administration systems and property markets, it is helpful to consider what informal markets are, and why their transition to formal property markets is generally desirable.

Property markets may be described as more or less formal according to the extent to which market activities are authorized and supported by government. (Williamson and Wallace, 2007)

Informal markets have met local needs in the local property markets of some countries for many years. People have relied on local authorities to recognize and validate local land transactions and transfers5. Where there was limited need for regional or international property markets, people tended to place greater trust in local officials and locally held records. Where public trust in central governments is not strong, and where corruption is commonplace, it is seen as preferable to trust local people. There can also be resistance to a movement toward formal markets where central governments introduce onerous property transaction fees and taxes, especially where people do not understand the broader benefits associated with a formal property market.

Over time, as property markets mature in developing countries, there is risk that locally approved transfers will not be recognized by the government or by the courts. But, governments need to tread carefully in the transition to more formal markets to avoid exacerbating land tenure security problems, thereby potentially increasing conflict, as evidenced by eviction of land occupiers in some developing countries. Early projects, focused on land titling, have shown benefits such as improved access to credit, increased land values and tax collection, but, as discussed later, such narrowly focused projects are not sufficient to the development of comprehensive, formalized property markets.

We have said that formal property markets are defined by the degree to which governments authorize and support the LAS. Thus, a key to success is that governments understand their role in reducing corruption and building public trust in land administration to achieve the desired benefits (e.g., increased tax revenue, land use control, wealth creation, economic growth and access to international capital markets).

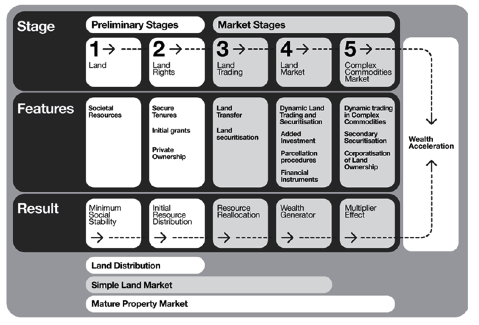

Williamson and Wallace, 2007 have described a five-stage evolutionary model whereby property markets advance from bureaucratic land distribution (e.g., in post-war periods) to complex commodities markets designed to help guide development of land administration systems, including valuation services, to promote a country’s economic development (Figure 2)6. Advancing through each stage – from land trading (3), through land market (4) to complex commodities market (5) – requires greater sophistication and support from valuation professionals in order to develop the investor and public confidence necessary to success in international market places.

FIGURE 2: Evolutionary stages to support formal property markets7

Helping to build capacity in the shift from informal to formal property markets

Also key to successful transition to formalized property markets is the ability of developing countries to draw on the collaborative experience and expertise of professional practitioners to expedite the transition, which has taken decades to accomplish in developed countries. Building capacity in the LAS of developing countries may be seen as an important part of the infrastructure needed to support global markets and to address growing global challenges like climate obligations, recent food shortage crises or the 2008 financial crisis. In other words, building LAS capacity is broadly beneficial and presents professional growth opportunities for LAS (including valuation) service providers and their professional organizations as they continually adjust to increasingly global business and market environments.

Successful transition to formal property markets requires building capacity among local property market participants, i.e., creating an awareness of the risks related to their informal markets and an understanding of mechanisms and advantages related to market formalization. A key focus in successful transition to formal property markets is development of the cognitive capacity of property market participants. As Williamson and Wallace state, “any transitional process needs to start much more with people’s attitudes, than with building GIS and titling programs.”8

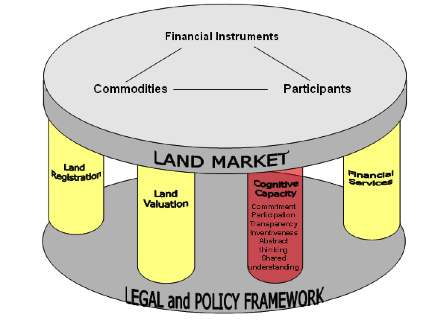

As appraisers know, people do not own land; they own rights to land – commonly referred to as a ‘bundle of rights.’ Those ‘rights,’ in whatever form they take, require valuation to facilitate decision-making in formal markets. So, bridging the gap from informal to formal property markets necessary to effective participation in regional or global markets (advancing from Stage 3 to 5 in Figure 2), means building the capacity to understand and benefit from abstract notions about the ‘bundle of rights.’ Creative ‘unbundling’ and commoditization, supported within a LAS frame, needs to be enabled by building the capacity of market participants to understand the nature of the commodities. This capacity is critical to shifting local market participants from simple land trading, to creating and marketing abstract land rights and complex commodities, related to property. Williamson and Wallace illustrate the complementary nature of cognitive capacity with the three ‘pillars,’ which have traditionally been understood to support land markets (Figure 3).

FIGURE 3: Land market supports and enablers

Building property valuation capacity

Not only do we need to create support among market participants for, and public confidence in formal markets, but, we also need to create the systemic capacity in the developing country to deliver property market services – including valuation.

Essentially, the developing country requires a scalable valuation system that builds public and investor confidence to meet initial policy requirements for supporting taxation and land use control policies, but with an increasing capability to deliver the professional services necessary to valuation of complex entities such as property related derivative commodities and ‘unbundled’ land rights. This emphasizes the need for professional capacity, in tandem with the jurisdiction’s responsibility to build infrastructure to engender investor confidence by providing for rule of law, public services capacity and a national capability to attract FDI and compete for capital in international marketplaces.

Valuation professionals can play key roles in helping the developing country to build a functional valuation system that supports the transition from informal to formal property markets. Areas in which valuation professionals can contribute include all those necessary to a functional property valuation system that supports government policy, and meets market participants’ needs within the broader land administration system. A few areas where professional/technical advisors can help the transition to formal markets include:

- development of national policy around valuation (e.g., related to property tax – periodic and transfer taxes, land use control mechanisms, investment and financial vehicles);

- creation of the legal and legislative framework to support early policy objectives such as property taxation and land use controls;

- development of governance and institutional frameworks, and collaborative professional organizations to enable valuation functions, and sustain public confidence;

- creation of valuation capacity – including education, training and continuing professional development; best practices benchmarking and adaptation; and technological innovations to meet local needs;

- adaptation of valuation standards and methodologies appropriate to country circumstances and culture;

- specification of codes of conduct and development of professional practices that are respected in international property markets;

- information management, related to property databases (ensuring transparency, accessibility and affordability of information to support domestic and international decision-makers); and

- public relations, education and awareness.

There are significant challenges to building capacity in property valuation in a developing country – valuations that support local market requirements, but also support evolution to mature property markets, i.e., to encourage wealth creation and economic growth, but not at the expense of destabilizing land tenure, creating conflict or exacerbating local poverty. If they take time to learn the local culture, Western societies have the expertise and experience to provide such guidance, and, in turn, they can benefit from building collaborative relationships and expertise that are a necessary preface to their own success in responding to global property market trends.

Conclusion

Paradigm shifts are occurring in land administration systems world-wide, responding to global trends and the changing requirements of international market participants. Developing countries need to build capacity in their LAS, including property valuation systems. And professionals in developed countries need to grow their knowledge and awareness to help ensure that clients, at home and abroad, are better served, and that valuation services continue to be relevant in a changing environment.

Appraisers and their professional organizations gain by contributing to coherent land management policies and to continuing improvement in land administration systems. Developing reliable valuation systems and building capacity to deliver valuation services throughout the evolutionary stages of international property markets are an integral part of that challenge.

As appraisers gain a better understanding of global issues, they are introduced to collaborative opportunities that allow meaningful contribution to poverty reduction, economic growth and wealth creation through more efficient and effective property markets.

End notes

i GTZ: Federal Ministry for Economic Cooperation and Development. Foreign Direct Investment (FDI) in land in developing countries. Deutsche Gesellschaft für Technische Zusammenarbeit (GTZ) GmbH. December 2009. URL website: http://www2.gtz.de/dokumente/bib/gtz2010-0060en-foreign-direct-investment-dc.pdf

ii FDI in land is such a new phenomenon that it is only beginning to be defined. An early definition by GTZ, GmbH is presented here: “FDI in land by a foreign company or state is based on a lasting interest in taking control over land use rights. The transaction includes either rights of land use or land ownership. The land use rights are generally valid for a limited period and can possibly be extended.”

International Land Coalition: Commercial Pressures on Land. URL website: http://www.landcoalition.org/cpl-blog/

2 Enemark, Dr S. The Land Management Paradigm. University of Melbourne, AU. Conference presentation: Incorporating Sustainable Development Objectives into ICT enabled Land Administration Systems. November 2005. URL website: http://vbn.aau.dk/fbspretrieve/2935555/SE_Melbourne_2005.pdf

3 Ibid, p. 7.

4 CDRI: Annual Development Review 2007-08. Cambodian Development Policy Research Institute. Brett Ballard: Chapter 5, From Informal to Formal Land Markets: Navigating Land Tenure in Cambodia, p.139. February 14, 2008.

5 CDRI: Annual Development Review 2007-08. Cambodian Development Policy Research Institute. Brett Ballard: Chapter 5, From Informal to Formal Land Markets: Navigating Land Tenure in Cambodia, p.140. February 14, 2008.

6 See Appendix A for a brief description of the five evolutionary stages of formal property market development.

7 Williamson and Wallace, 2007.

8 Williamson, Ian and Wallace. Jude (2007). Building Land Markets in the Asia Pacific Region. Paper delivered to international workshop on Good Land Administration – Its Role in Economic Development. Ulaanbaatar, Mongolia, p. 6. URL website: http://dtl.unimelb.edu.au/R/4YPLLC17LHT8S7PCL57RFFXBAS4MS8KYY998RR2K7UAEX84T1D-00503?func=dbin-jump-full&object_id=67711&local_base=GEN01&pds_handle=GUEST

NOTE

This is a condensed version of this article. To read the article in its entirety, please visit https://www.aicanada.ca/cmsPage.aspx?id=168

CRAIG – from this point on will not be included in the magazine however we would like it included in a longer version of the article we will post on the website.

(Mary-Jane – April 8/2010)

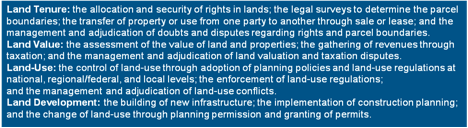

APPENDIX A: Simplified characteristics of evolutionary stages of land markets

Williamson and Wallace present five evolutionary stages in the development of formal land markets (Table 1), designed to help guide development of land administration systems, including valuation services, to promote a country’s economic development:

Stages 1 and 2 are preliminary, providing for minimal social stability and very basic resource distribution. Clear definition of land tenure and rights and a functional LAS (including valuation capability) are essential to later stages (3 – 5) in property market development. While land distribution may need to occur through a central, bureaucratic mechanism in a dysfunctional informal market (say, in a post-war period), commoditized property interests in a mature market is a more successful form of rationalization.

| Table 1: Simplified characteristics of evolutionary stages of land markets (Williamson and Wallace, 2006) | |

| Stages | Characteristics |

| 1. Land | A group or country establishes a defined location with territorial security. The securing of spatial relationships in land arrangements among competing groups is fundamental to all later developments. |

| 2. Land rights | Within the group, regularities of access create expectations that mature into rights. In formalised systems, these rights are reflected in the legal order. In some of these, the legal order is further embedded in the formal infrastructure of the land administrative system (LAS). The crucial element of the participants’ cognitive capacity starts with ‘my land’ and ‘not my land,’ and matures into everyone appreciating ‘your land.’ The power derived from land ownership is also managed and restricted via taxation and other systems. |

| 3. Land trading | Virtually at any time during Stage 2, members of the group will develop a process of trading land. The traded rights in land evolve into property, the basic legal and economic institution in formal land markets. As economies become more complex, trading will include strangers and will depend on objective systems of evidence, and eventually on a well-run programme of recording property rights. Inheritance tracking processes will also develop. Commoditization processes will involve public capacity to view land as offering a wide range of rights, powers and opportunities. The better these are organized and understood, the better the market will operate. |

| 4. Land market | Trading increases in scale and complexity until it develops into a property market. In the latter, rights are converted with ease into tradable commodities. Significant government infrastructure supporting market activities in land stabilises commoditisation and trading. Land is used extensively as security, multiplying opportunities to derive capital. Capacity to invent and market new commodities emerges and gains strength. |

| 5. Complex market | Market stability allows the spontaneous invention of complex and derivative commodities and ‘unbundling’ of land. This involves both imagination and globalisation. Typical Stage 5 machinery includes corporatization, securitization and separation. The system relies heavily on the rule of law, government capacity, and national ability to compete for capital in international markets. |

References

CDRI: Annual Development Review 2007-08. Cambodian Development Policy Research Institute. Brett Ballard: Chapter 5, From Informal to Formal Land Markets: Navigating Land Tenure in Cambodia. February 14, 2008.

CDRI: Cambodia Land Titling Rural Baseline Survey Report, December 2007.

Williamson, Ian and Wallace. Jude (2007). Building Land Markets in the Asia Pacific Region. Paper delivered to international workshop on Good Land Administration – Its Role in Economic Development. Ulaanbaatar, Mongolia. URL website: http://dtl.unimelb.edu.au/R/4YPLLC17LHT8S7PCL57RFFXBAS4MS8KYY998RR2K7UAEX84T1D-00503?func=dbin-jump-full&object_id=67711&local_base=GEN01&pds_handle=GUEST

World Bank. Regional Study on Land Administration, Land Markets, and Collateralized Lending

East Asia and Pacific Region, 1818 H Street NW, Washington, DC 20433. June 2004.

GTZ, on behalf of Federal Ministry for Economic Cooperation and Development. Foreign Direct Investment in Land in Developing Countries. Deutsche Gesellschaft für Technische Zusammenarbeit (GTZ) GmbH. December 2009. URL website: http://www2.gtz.de/dokumente/bib/gtz2010-0060en-foreign-direct-investment-dc.pdf

Davies, K., Lyons, K. & Cottrell, E. The Efficiency and Effectiveness of Land Administration Systems in Australia and New Zealand. 2001 – A Spatial Odyssey: 42nd Australian Surveyors Congress. 2001. URL website: http://www.isaust.org.au/groupCadastral/PDFs/davies.pdf

Bandeira, P., Sumpsi, J. and Falconi, C. Evaluating land administration systems: a comparative method with an application to Peru and Honduras. Universidad Politencia de Madrid, Inter American Development Bank. July 2008. URL website: http://mpra.ub.uni-muenchen.de/13370/1/MPRA_paper_13370.pdf