The retail landscape in Canada

Canadian Property Valuation Magazine

Search the Library Online

The global retail environment is in the midst of an industry wide shift, as the online shopping experience continues to improve. Consumers are placing a greater emphasis on convenience and today’s successful retailers are combining bricks and mortar stores with e-commerce to drive total sales. Additionally, some companies are breaking the mold by first opening online stores and then expanding via physical storefronts.

Canadians saw a number of new retailers and restaurants enter the market in 2016, while other recent additions continued their expansion. Much was made about the rapid departure of Target, but most of the space they left behind has been re-leased. Additionally, the global appetite for products made in Canada has helped revive Canadian clothing manufacturers like Canada Goose. Retail spending amongst consumers increased nationally in 2016, and 2017 is expected to be no different.

From a provincial perspective, Manitoba’s consistent positive growth has started to attract national headlines. The province’s diversified economy helps to avoid boom and bust cycles, while low unemployment provides boots on the ground for retailers. High construction costs constrain supply and avoid overdevelopment.

Retail in general

To see just how much retail has changed over the last 20 years, one need look no further than the market cap of companies like Amazon and Alibaba, as compared to companies like Walmart and Sears. Amazon is valued at $350B, while Alibaba is valued at $191B, despite only both having one physical store. Compare this to Walmart, valued at $285B, with 6,290 stores, and Sears, valued at $19.7B, with 717 stores.

Further, retailers like Harry’s and Warby Parker broke the traditional mold by achieving eight digit valuations via their online stores. Harry’s manufactures and sells high quality razor blades, while Warby Parker designs and sells its own trendy eyeglasses and sunglasses. In 2015, Harry’s was valued at $750M, despite only having one location, while Warby Parker was valued at $1.2B, with 30 store fronts.

While the shift to online sales has harmed some formerly heralded retailers, others like Home Depot and Lowes have been able to benefit by creating an unrivaled omni channel experience. Both companies have used their bricks and mortar locations as distribution centres in an effort to drive total sales. At Home Depot, 2015 revenue was up $13B to $83B as compared to 2012 revenues of approximately $70B. By allowing customers a wider range of products online, with in store pickup, big box stores have the potential to provide the best of both worlds. Additionally, the stores enjoy the cost savings associated with being able to house a broader range of product in one centralized location.

Millennials shop online more than baby boomers, but they still enjoy visiting stores. Their in-store demands are much different from those of baby boomers. For example, millennials generally prefer avoiding sales people when possible – they are more content doing their own research and browsing on their own. Conversely, baby boomers favour stores with excellent in-store service. In order to adjust to the trend, retailers must continue to innovate and improve the in-store experience to drive traffic. We are seeing large department stores pivot, with dining being a key part of the recently renovated Hudson’s Bay on Queen Street in Toronto, and the newly opened Nordstroms at the Eaton Centre. The Oliver & Bonacini group is responsible for the food hall in the basement of The Bay, while there is a sports bar in the men’s section at Nordstroms.

More retail assets are being tenanted with businesses that offer consumers something to eat or do. Examples include escape rooms, 24/7 gyms and better burger restaurants. As appraisers, we must be cognizant of the stable and predictable cash flows that these businesses generate. Not having to rely on keeping up with the latest fashion trends provides operators with more continuity and less risk on a year-to-year basis.

Canadian retail

The Canadian retail market continues to perform well despite headwinds from oil prices and closings like Target and Future Shop. The majority of the boxes these companies left behind have been absorbed as new businesses continue to enter the market.

I am old enough to remember the publicity over the closing of Woodwards. Abandoned locations were home to squatters and pigeons, but the spaces were ultimately repositioned, and a number of shopping centres that housed the retailer have since expanded. Later, when retailers like Simpsons and Eatons closed, Canadians were once again worried that we were losing “iconic for some” retailers.

The most notable departure of 2016 was certainly Target’s. The general consensus is that the closure had much less to do with the Canadian consumer and much more to do with Target’s inability to execute. The company expanded too quickly and was unable to stock shelves with the products that Canadians craved – the products they were used to buying in Target’s American stores. Empty shelves combined with higher prices resulted in 133 big box stores across Canada suddenly becoming available. Target’s parent company was responsible for 29 of these leases, while most of the others have since been released to different retailers.

Because of the resiliency the Canadian retail market has demonstrated, companies continue to view Canada as a source of new customers. This can be seen with luxury department stores like Nordstroms opening six stores and Saks opening four stores across the country. Quick service restaurants like Chipotle and Panera also continue to expand, while the organic grocer, Whole Foods already has 11 Canadian locations.

According to RBC Economics, retail spending amongst consumers in Canada is expected to increase by 3.7% y/y in 2016. In December of 2015, shopping malls across the country saw a 4.2% increase in sales per square foot, with Alberta being the only province that experienced a decline. Strong consumer spending has helped keep vacancy low, with most super regional malls across the country enjoying sub 4% vacancy. Landlords like Cadillac Fairview have been able to reinvest in their asset base while expanding existing malls as a result of the demand for space.

Canadian clothing labels have enjoyed a renaissance with ‘Made In Canada’ carrying a global cache. No company represents this better than Canada Goose, perhaps the best-known parka designer of the 21st century. Superior products combined with the ability to market ‘Made in Canada’ have allowed the company to earn the trust of customers from around the globe.

A steady economy combined with Canada’s close proximity to the United States means that our country is likely to be home to more and more best-in-class global retailers. The Canadian market is not overdeveloped, and high replacement costs mean that existing assets are well positioned to succeed in the future.

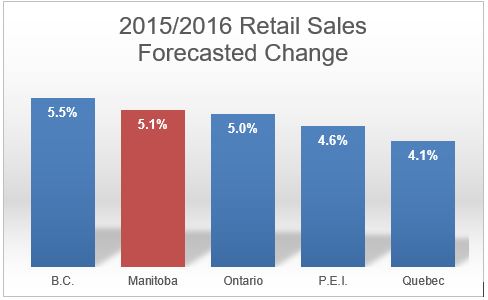

Manitoba – A strong performer within the Canadian retail landscape

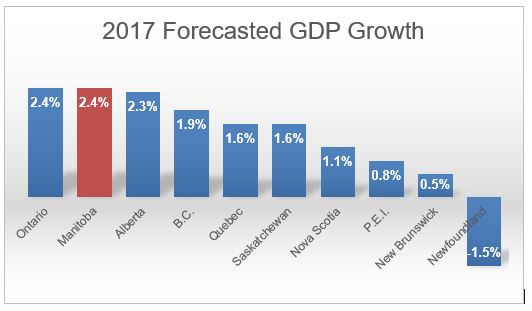

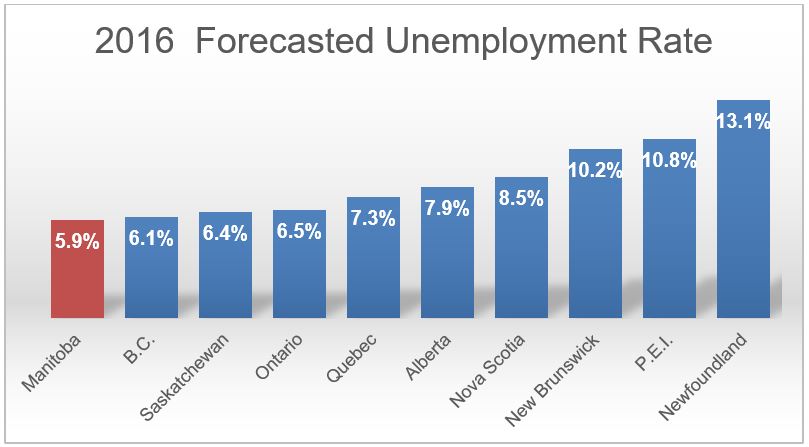

Manitoba had the third highest GDP growth of any province in 2015, and 2016 is projected to be the same. In 2017, RBC Economics thinks that Manitoba and Ontario will be the best performing economies in Canada, with forecasted growth of 2.4%. At a projected 5.9% in 2016, RBC also thinks Manitoba will have the lowest unemployment rate nationwide. Strong GDP growth combined with low unemployment is expected to drive a 5.1% increase in retail sales in 2016, the second highest behind only BC. Manitoba’s outperformance continues to gain national attention, with more retailers and institutional inventors gaining interest in the province’s assets

A strong manufacturing base, combined with international trucking companies and crown corporations provides Manitoba with solid employment. As a Winnipegger, I am often pleasantly surprised to see what is being made for export when I drive by non-descript industrial buildings around the city. Canada Goose has a local manufacturing facility. MacDon, one of the largest manufacturers of agriculture equipment in the world, is headquartered in Winnipeg. International trucking giants Trans X and Bison Transport are also locally owned and operated.

On April 30, 2016, The Globe and Mail ran a featured article entitled Winnipeg: Canada’s Unlikely Economic Sweet Spot. One of Canada’s most successful tech startups, Skip the Dishes, was profiled, as the company decided to locate its head office in Winnipeg. Founder Joshua Simair said that he was intrigued by Winnipeg’s low cost of living, its deep underutilized talent pool, and the city’s strong sense of community. The Globe also indicates that, as a result of Manitoba’s diversified economy, real GDP shrank by only 0.2% in 2009, while Alberta, Saskatchewan and Ontario experienced declines of 5.5%, 5.3% and 3.1% respectively.

On a per square foot basis, Manitoba is not over retailed. Since 2000, the province has seen its total inventory of retail space increase by 3M square feet. The vacancy rate is 4.6% for community strips, 4.7% for power centres, and 7.2% for regional malls. It is important to note that a few tired, underperforming assets skew the data for regional malls. The high cost of construction is partly responsible for the tight supply in the market. Shopping centres that offer excess land for expansion are considered especially valuable in the Manitoba market.

Manitoba’s slow, steady growth means that assets do not become economically obsolete as quickly as they do in other Canadian and American cities. Additionally, the predictability of the Manitoba economy means cash flows are more certain, resulting in the kind of low volatility investments that many investors demand. Retail assets rarely come for sale, so, when they do, these factors make them trade at premium multiples. Job growth, combined with positive immigration, should continue to increase the demand for space, while high construction costs restrict developers’ ability to add an abundance of square footage to the market.

Indicative of this positive outlook for the Keystone province, Shindico Realty has a robust pipeline of projects in Manitoba, with 6M+ square feet planned. The majority of our projects under development are signature infill properties. Over 1,000,000 SF of mixed-use development is planned at Grant Park Pavilions in one of Winnipeg’s most desirable neighborhoods – River Heights. The Plaza at Polo Park is a joint venture with Cadillac Fairview located at the former Winnipeg Blue Bombers stadium site. Adjacent to Winnipeg’s best performing mall, Polo Park, this 600,000+ SF project will house offices, retail, and a hotel. Westport Festival also offers over 1,000,000 SF+ conveniently located at the Red River Exhibition Grounds, which houses a number of national and international trade shows focused on agriculture.