Accelerating innovation in commercial real estate

Canadian Property Valuation Magazine

Search the Library Online

Virtually every industry is currently working to create greater value through process efficiencies, better data and analytics, and new applications that help to streamline business and commercial real estate (CRE) is no different. In an article I wrote last year for Canadian Property Valuation, I talked about how the CRE industry was beginning to recognize the benefits of investing in technology and the overall value of data and analytics. Valuations and Appraisals is a sector of the industry where many aspects are ripe for automation, so this year we are looking at the next phase of how the industry is adopting new disruptive technology, and which technologies will have the most significant effect on the appraisal industry specifically.

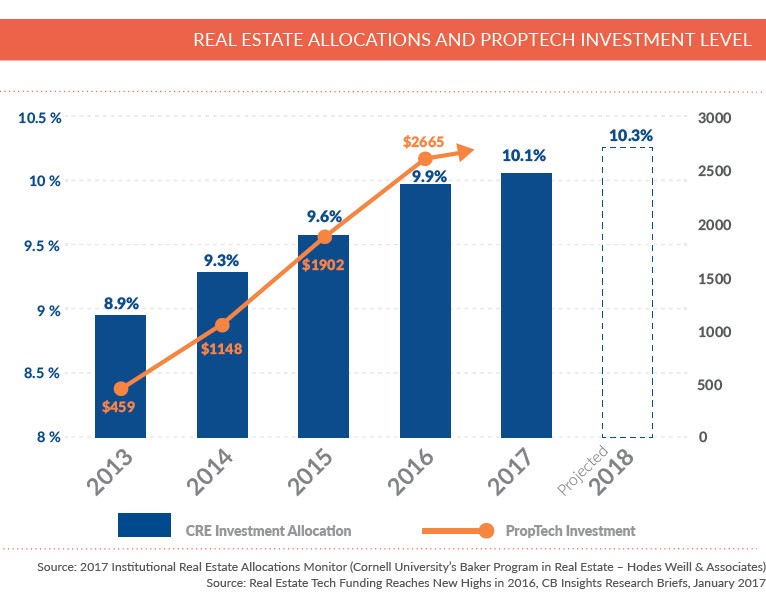

With CRE’s established position as the fourth asset class, we are now seeing an explosion of venture capital investment in PropTech. Both real estate allocations and PropTech investments are continuing to grow, as, increasingly, firms are recognizing they must start thinking critically about how technology can be used to create efficiencies and enhance the ways in which data and analytics are used.

Emerging Technologies

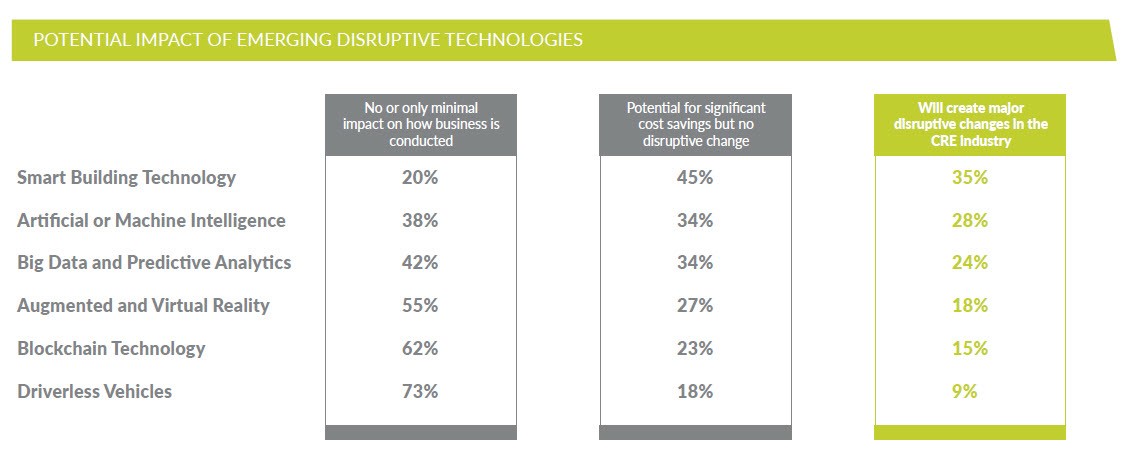

The 2017 Altus Group CRE Innovation Report surveyed 400 CRE C-level and senior executives globally and discovered a big disconnect amongst this group when it comes to technology and innovation, and what is upcoming for the industry in these areas. When asked about six emerging disruptive technologies and their potential impact on the industry, only a minority of respondents recognized these technologies as having the potential for major disruptive impact:

Of these disruptive technologies, two stand out from a valuation standpoint: Artificial Intelligence (AI) or Machine Intelligence (also known as Machine Learning) and Big Data and Predictive Analytics. There is no doubt in my mind that these technologies are going to upend the appraisal profession, but only a quarter of executives surveyed see these two technologies as having the potential for major disruption.

Using AI to optimize efficiency

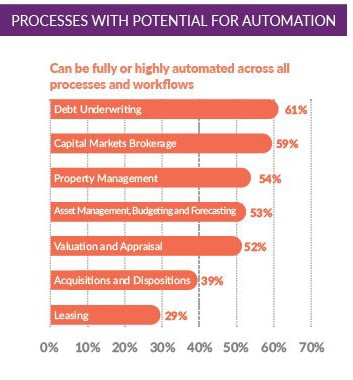

The most extensive benefit AI can offer lies in mundane tasks that can be automated, and 52% of respondents see Valuations and Appraisals as one of these areas. Take lease review for example: a company in Sweden is working on a tool that optically scans leases and pulls out key terms like ‘net rent,’ which can cut down the review time of these documents by 75%. Implementing AI and Machine Learning in areas like this can generate major cost savings and greatly increase efficiencies in a firm. Technology is also being used to normalize and standardize practices across the industry, and spreadsheets are a great example. Spreadsheets are one of the fundamental tools used by CRE professionals and can be meaningfully improved by technology. Products like ARGUS Developer and ARGUS EstateMaster are already in market and using technology to standardize and normalize the development feasibility process.

Altus Group and several other firms are also working on enhancing automated report templates in ways that will make them more succinct, informative and ultimately interactive. Gone (or soon to be gone) are the days of paper reporting. In 2018, our clients are consuming reports in different ways than in the past, and different groups within a given firm (i.e., finance, portfolio management, development, risk, etc.) are utilizing appraisal reports. What we are seeing now is a shift where reports are becoming shorter in length, more graphic and visual, and also more collaborative, pulling data from various sources.

Harnessing the power of Big Data

As CRE transitions into a data-driven industry, firms of all sizes need to embrace technology. Having the ability to access and collect Big Data is one aspect, but Big Data and Predictive Analytics go hand in hand, and firms also need to be able to process and interpret this data. How quickly can your firm sift through your data and extract key information, trends or patterns to provide meaningful insights? As the industry increases its use of data, the answer to this question will be the difference between successful firms and those left behind.

A perfect example of how Big Data and Predictive Analytics can be used to create value lies in the rise of e-commerce and the related demand for distribution centres. Companies like Amazon use data to look at where consumers are and they use that data in combination with other factors to determine which locations provide the best value for distribution centres. The growth of e-commerce represents a fundamental shift in CRE and the disproportionately high costs associated with last mile fulfillment gives valuation professionals an opportunity to provide greater value for their industrial clients in assisting them with things such as site selection criteria and ultimately development strategy.

Enhancing performance management

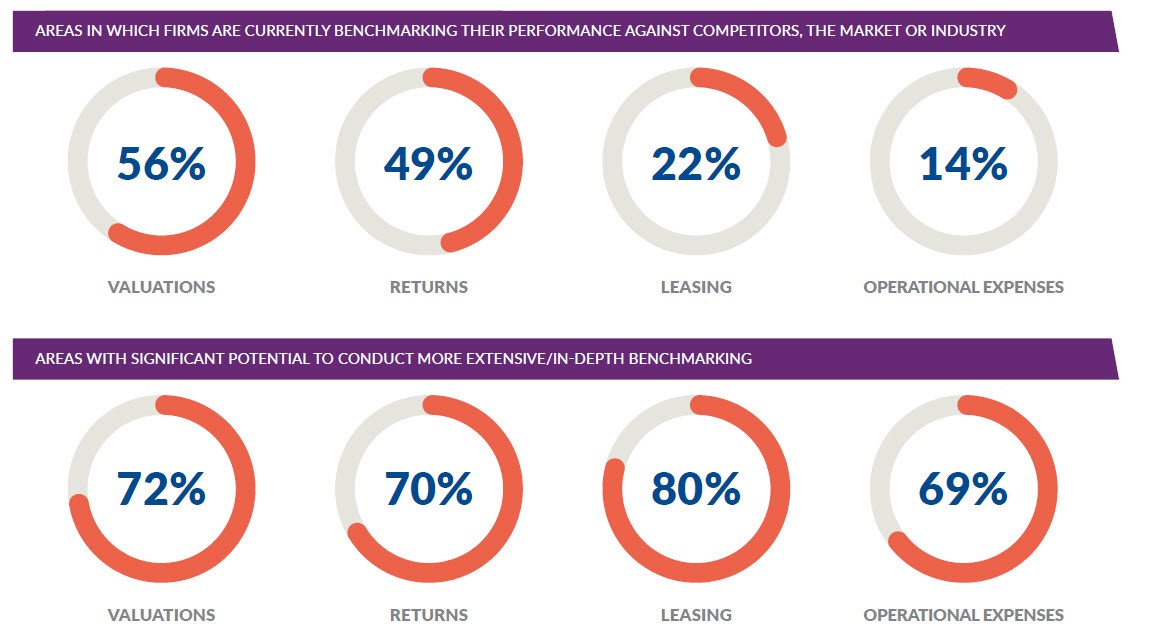

Advancements in technology provide a major opportunity for CRE firms to improve their operational efficiency and performance management and, in turn, improve shareholder and client returns. 56% of executives surveyed are already benchmarking valuations against competitors, the market or the industry, but 72% see valuations as an area with significant potential to conduct more extensive benchmarking.

We are also seeing systematic changes in how valuation teams are set up across the country, as many firms shift to a more centralized model. Instead of using regional teams to value assets across the country, there may be a national portfolio team which centralizes some of the processes and creates efficiencies in that way. As technology becomes more ingrained in different aspects of the valuation profession, it will be crucial for firms to examine both their processes and structure, to make sure new technology is being used to derive maximum value for their clients.

Commercial vs. residential

The commercial real estate industry is lagging the residential sector in adopting new disruptive technology, simply by the nature of the sectors. The residential market is much more homogeneous than the commercial market, and is already using regression models, indexes and various tools aimed at quickly and accurately valuing residential properties. This is an interesting time for the commercial sector, as we are starting to see some of these new technologies come to bear, and firms that will be successful are already embracing new technologies and figuring out how to marry them with their existing business models.

The wave of the future

The bottom line is that we, as an industry, need to embrace disruptive technologies as the wave of the future. We need to augment our skillsets and think critically about how tools like AI and Machine Learning can be used to replace some of the more mundane tasks. We are not going to be replaced by robots anytime soon, but factors like continuing fee compression requires the automation of certain tasks to create efficiencies.

The CRE industry will change a lot in the next three to five years and will look dramatically different in 10 years. While successful firms will be maximizing their use of automation to create efficiencies, judgment and market knowledge are going to be more important than ever, particularly around data interpretation, feasibility analysis and development, and redevelopment strategies. When increasing amounts of the industry has access to data, the major competitive advantage lies in how quickly you can interpret, process, normalize and standardize your data to pull out meaningful insights that can inform your clients. As I mentioned earlier, our research found that over half of CRE executives believe Valuations and Appraisals can be fully or highly automated, so we should be preparing now, and critically thinking about how AI, Machine Learning and Predictive Analytics can be strategically implemented to build a sustainable competitive advantage.