Adapt your business to the new reality

Canadian Property Valuation Magazine

Search the Library Online

Adapt your business to the new reality

By Michael G. Jacobides and Martin Reeves

Reprinted with permission from the September–October 2020 Issue of the Harvard Business Review

It will be quite some time before we understand the full impact of the COVID-19 pandemic. But the history of such shocks tells us two things. First, even in severe economic downturns and recessions, some companies are able to gain advantage. Among large firms doing business during the past four downturns, 14% increased both sales growth rate and EBIT margin.

Second, crises produce not just a plethora of temporary changes (mainly short-term shifts in demand), but also some lasting ones. For example, the 9/11 terrorist attacks caused only a temporary decline in air travel, but they brought about a lasting shift in societal attitudes about the trade-off between privacy and security, resulting in permanently higher levels of screening and surveillance. Similarly, the 2003 SARS outbreak in China is often credited with accelerating a structural shift to e-commerce, paving the way for the rise of Alibaba and other digital giants.

In this article, we discuss how companies can reassess their growth opportunities in the new normal, reconfigure their business models to better realize those opportunities, and reallocate their capital more effectively.

Reassess growth opportunities

The COVID-19 pandemic has severely disrupted global consumption, forcing (and permitting) people to unlearn old habits and adopt new ones. A study on habit formation suggests that the average time for a new habit to form is 66 days, with a minimum of 21 days. As of this writing, the lockdown has already lasted long enough in many countries to significantly change habits that had been the foundation of demand and supply.

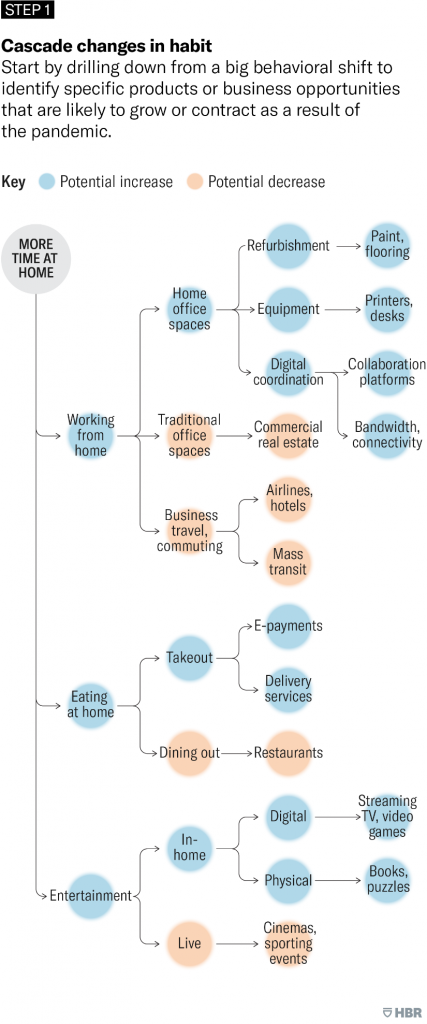

Companies seeking to emerge from the crisis in a stronger position must develop a systematic understanding of changing habits. For many firms, that will require a new process for detecting and assessing shifts before they become obvious to all. The first step is to map the potential ramifications of behavioral trends to identify specific products or business opportunities that will most likely grow or contract as a result. Consider how the pandemic has caused people to stay at home more. Implications include an increase in home office refurbishment, driving greater demand for products ranging from paint to printers. Unless we sensitize ourselves to new habits and their cascading indirect effects, we will fail to spot weak signals and miss opportunities to shape markets.

How to identify growth opportunities

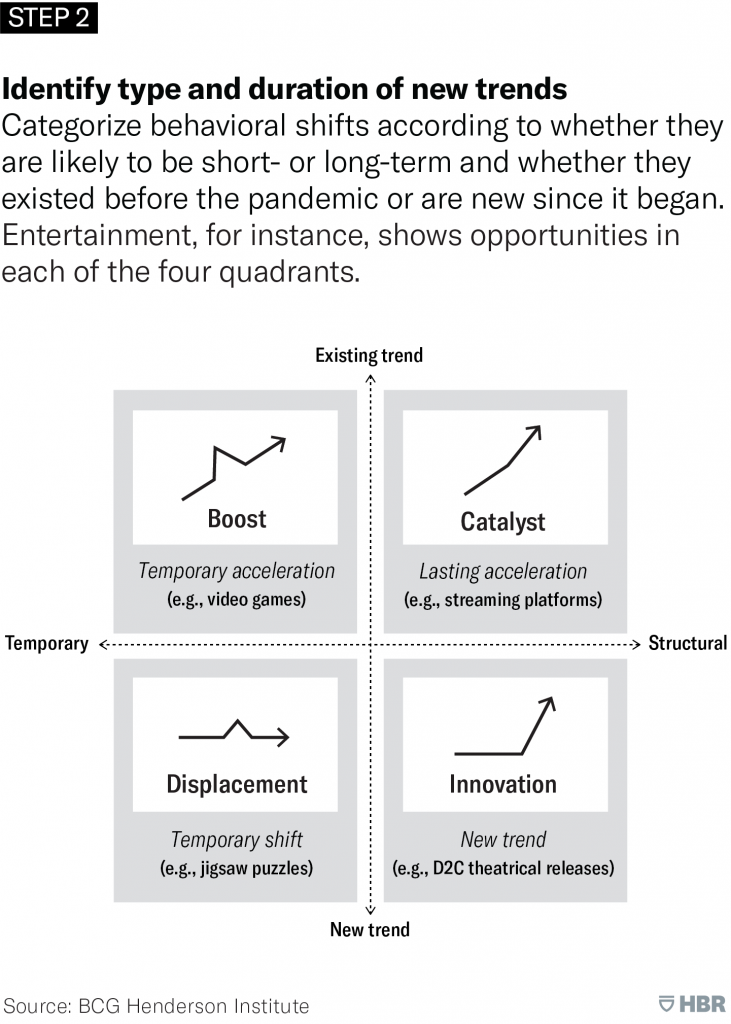

The next step is to categorize demand shifts using a simple 2×2 matrix, on the basis of whether they are likely to be short-term or long-term and whether they were existing trends before the crisis or have emerged since it began. The four quadrants distinguish among boosts (temporary departures from existing trends), displacements (temporary new trends), catalysts (accelerations of existing trends), and innovations (new lasting trends). Consider again the behavioral shift of ‘stay at home more,’ which has had a serious impact on retail shopping. The question is, will the shift away from retail stores to online be temporary, or will it be a structural change with permanent knock-on effects in other areas, such as commercial real estate?

We would place shopping in the catalyst quadrant. The pandemic has amplified and accelerated an existing trend rather than created a new one; people were shifting to e-shopping before the lockdown. But the shift is structural rather than temporary, because the scale and duration of the enforced switch, coupled with the generally positive performance of the channel, suggests that, in many shopping categories, customers will see no need to switch back. So retailers must shape their strategies to the new normal. Indeed, before the lockdown, many retailers were responding to the digital challenge by redefining the purpose of the physical store, often by reimagining shopping as not a chore, but an attractive social experience.

This framework can therefore be used to highlight which trends to follow and which to shape more aggressively. Companies cannot pursue all possibilities and should not try to. To get an idea of which ones to back, ask yourself whether any shift in demand is temporary or permanent. Many of the immediately observed shifts in response to COVID-19 were driven by fear of infection or compliance with official directives, and therefore were most likely temporary. But others were accompanied by greater convenience or better economics, so they are more likely to stick.

Any analysis of growth opportunities must go well beyond a simple categorization of what you already know. You need to challenge your ideas about what is happening in your traditional business domains by taking a fresh, careful look at the data. This requires that you actively seek out anomalies and surprises.

Dive deep into the data

Anomalies usually emerge from data that is both granular (revealing patterns hidden by top-line averages) and high-frequency (allowing emerging patterns to be identified rapidly). As behavior changed with the outbreak of COVID-19, for example, rich sources included data on foot traffic and credit card spending. An analysis showed that the recent drop-off in cinema attendance occurred before theaters were shut down in the United States. This, combined with an existing trend of declining attendance, suggested that the shift was consumer-driven and perhaps likely to persist in the absence of innovation. Live sports attendance, in contrast, declined only when events were officially canceled, suggesting a stronger possibility of a behavioral rebound.

Take multiple perspectives

In the military, a technique for discovering what you do not know is to use the ‘eyes of the enemy.’ Military leaders ask themselves, what is the enemy paying attention to? They then shift their own attention accordingly to illuminate potential blind spots and alternative perspectives. The same can be applied to industry mavericks and competitors: Who is doing well? What market segments are your rivals focused on? What products or services are they launching? The same principle can be extended to customers: Which ones are exhibiting new behaviors? Which have stayed loyal? What new crisis-induced needs do customers have, and what are they paying attention to? It can even be applied to countries: What patterns emerged in China, where both the outbreak and the recovery came ahead of those in Western nations? In your own organization, ask: which workplace innovations are taking hold in leading firms? What new needs are employees responding to? What opportunities do they represent that could potentially be developed and rolled out more broadly?

Armed with an understanding of where your opportunities lie, you can now move to the next step: shaping your business model to capture them.

Reconfigure your business model

Your new business model will be shaped by the demand and supply shifts relevant to your industry. Many manufacturing companies, for example, will be profoundly affected by the structural and likely permanent shocks to globalization brought on by the pandemic. With big markets such as the United States raising trade barriers, for example, many companies will need to re-shore critical components in their supply chains – from R&D down to assembly.

To figure out what business model the new normal requires, you need to ask basic questions about how you create and deliver value, who you will partner with, and who your customers will be. As an example, let’s look at how retail shopping businesses should be adjusting to the demand shift to digital.

Can you take the value you offer online?

The value that many retailers provide to customers traditionally has come from the quality of their in-store service. Consider the Chinese cosmetics company Lin Qingxuan. It suffered a 90% collapse in store sales after the outbreak, when many locations were forced to close and others saw foot traffic plummet. In response, the company developed a strategy for digital engagement with customers that would replace the store experience: it turned the company’s in-store beauty advisers into online influencers. The success of this move has prompted more investment in digital channels. Thanks to that and similar changes, Lin Qingxuan’s increased online sales have more than made up for the fall in store sales during the crisis, notably in hard-hit Wuhan.

Which platforms should you work with?

The pandemic-induced shift to digital shopping has made customers and firms more dependent on big digital platforms, including Google, Amazon, and Apple in the West and Alibaba and Tencent in Asia, along with a newer group of aggressive rivals such as China’s Meituan, Russia’s Yandex, and Singapore’s Grab. Increasingly, a firm’s competitive space will be determined by the platform it works with. As retailers seek to carve out a distinctive position for themselves, they will have to learn to work with such platforms to innovate and shape their value propositions. For example, Lin Qingxuan’s conversion of shop assistants into online influencers involved working in close partnership with Alibaba. The choice of platform to partner with should be driven by its ability to help you develop the strategic digital capabilities and resources you need to provide value online.

Can you expand your customer niche?

Digitization provides scope for niche businesses to expand their markets, perhaps across borders or into adjacencies not currently well served. Take the case of VIPKid, one of China’s unicorns, which links teachers in English-speaking countries with Chinese children who want to learn English. With teaching switching from physical to online, the company has seen an opportunity to expand and deepen its links both with students in China and with teachers in the United States, Canada, and the UK. Niche companies in other industries may find potential for online offerings in segments already being served by strong digital providers, because of a selective wariness toward Big Tech that has become more apparent during the crisis. The distribution platform Bookshop.org, for example, links up independent bookstores that are worried about being exploited or ignored by Amazon. My Local Token also taps into a desire for alternatives to Big Tech, providing a cryptocurrency that enables local merchants to lower transaction fees, build customer loyalty, and reinvigorate small businesses. Ventures like these, whose value proposition is rooted in opposition to the network-maximizing ethos of Big Tech firms, could be described as Alt-Tech.

For the vast majority of companies, responding to demand shifts will involve at least some digital transformation – and probably a significant level of it. Microsoft CEO Satya Nadella observed at the end of April, “We have seen two years’ worth of digital transformation in two months” among enterprise customers – and the result of those investments will persist long after the crisis. Employees at companies across the board have adjusted to working remotely and collaborating via video conferences. Many of those habits and patterns will stick.

Together, these factors explain why, in a survey of Fortune 500 CEOs, 63% said the COVID-19 crisis would accelerate their technological investment despite financial pressures. Only 6% said it would slow it down. But to make a difference, those IT investments should focus on specific business-model innovations to address new opportunities, rather than increase the use of digital technologies in general.

Reallocate your capital

It may be psychologically hard to do during a crisis, when cash flows are stressed, but now is precisely the time to take a few well-considered risks. Research shows that the most successful companies not only invest more than their peers in new opportunities, but also put their eggs in fewer baskets, devoting more than 90% of net spending to segments with higher growth and returns. These companies recognize that a crisis offers an opportunity to carve out a new competitive position.

Unfortunately, many companies are still defaulting to traditional habits of ‘peanut-buttering’ new funding across the business and, when necessary, making horizontal cuts rather than targeted ones. According to BCG’s survey of leading firms, as of May 2020, only 39% of companies had modified their investment and capital allocation plans to target new growth drivers, and of that minority, only half had made investments in new business models.

Rather than hoard cash, CEOs need to engage in more-aggressive capital investment

To avoid that trap, evaluate your capital investment projects along two dimensions: their estimated value tomorrow, after taking into account the impact of demand shifts, and the amount of money needed to keep them alive today in light of often constrained operational cash flows. You can do this at the business unit level, but ideally you should dive deeper to examine specific operations or initiatives. Once you have completed this exercise, you will most likely realize that you need to radically reallocate your capital investment.

In the current environment, larger corporations that are willing to entertain some risks are likely to benefit the most. Financial markets and institutions will be less ready or able to provide capital to smaller firms and start-ups right now. This means that large, established firms with relatively strong cash flows, and more access to capital as a result, will be well placed to take advantage of the opportunities afforded by shifts in demand.

But large companies need to be prepared to take on those risks. Rather than hoard cash and agonize about what might befall a particular sector or geographic region, CEOs should engage in more aggressive, dynamic capital investment. Heightened uncertainty means that organizations cannot accurately predict which businesses will be most successful tomorrow, so they need to take an experimental approach and take steps to diversify their portfolios to include a range of potential bets. The rapid pace of change means that they should frequently update their portfolios, reallocating funding as needed while making sure that they are balanced over time and fit the companies’ long-term strategic priorities.

American Express has set the standard in this regard. During the 2008 global financial crisis, Amex was severely threatened by increasing defaults, decreasing consumer spending, and limited access to funding. The company launched a restructuring program to streamline the organization and reduce cash drain, and it entered into the deposit-gathering business in order to raise more capital. Those moves freed up or generated cash that Amex then directed toward longer-term investments in new partnerships and technology, which reimagined the company as not just a card provider, but a platform-supported services company. As then-CEO Ken Chenault noted, “Even as we have cut operating expenses, we have continued to fund major growth initiatives.” As a result, Amex’s market capitalization grew more than 10-fold after the crisis.

Conclusion

In times of crisis, it is easy for organizations to default to old habits – but those are often the times in which new approaches are most valuable. As companies position themselves for the new normal, they cannot afford to be constrained by traditional information sources, business models, and capital allocation behaviors. Instead they must highlight anomalies and challenge mental models, revamp their business models, and invest their capital dynamically to not only survive the crisis, but also thrive in the post-crisis world.