Will the US Sub-Prime Crisis Head North?

Évaluation immobilière au Canada

Rechercher dans la bibliothèque en ligne

By John T. Glen, MA, AACI, FRICS, MIMA

INTRODUCTION

I believe that there will be a spill over of the US sub-prime crisis into Canada in terms of a reduction of real estate transactions, prices and building activity. To support this forecast, this article compares residential and investment property markets in both countries. After a brief overview of the history of sub-prime lending in the US and the key reasons for the current lending crisis, I will compare US and Canadian residential lending practices to see whether the conditions which lead to the US sub-prime crisis also exist in Canada, and then show how, through the vehicle of debt securitization, mortgage backed securities have spread the problem to other parts of the credit markets.

SUB-PRIME GLOSSARY

Definitions

Prime, non-prime and sub-prime are terms relating to a borrower’s credit rating. FICO1 credit rating scores can vary from 300 to 850. TransUnion credit scores vary from 300 to 9002.

Prime borrower

A borrower with a very good credit rating and one capable of providing at least a 20%-25% down payment.

Sub-prime borrower

This term has come to describe borrowers with fair to poor credit ratings who would not normally qualify for a conventional mortgage requiring a 20% down payment and a credit rating. Some lenders required no documentation of a borrower’s income.

Sub-prime borrowers are generally defined as individuals with limited income or having FICO credit scores below 620 on a scale that ranges from 300 to 850.

Sub-prime mortgages

Sub-prime mortgage loans are riskier loans in that they are made to borrowers unable to qualify under traditional, more stringent criteria due to a limited or blemished credit history. Sub-prime mortgage loans have a much higher rate of default than prime mortgage loans and are priced based on the risk assumed by the lender.

SUB-PRIME CRISIS

Beginning in late 2006, the US sub-prime mortgage industry entered what many observers have begun to refer to as a meltdown. A steep rise in the rate of sub-prime mortgage foreclosures has caused more than two dozen sub-prime mortgage lenders to fail or file for bankruptcy. The failure of these companies has caused prices in the $6.5 trillion mortgage-backed securities market to collapse, threatening broader impacts on the US housing market and economy as a whole. The crisis is ongoing and has received considerable attention from the US media and from lawmakers during 2007 and 2008.

Sub-prime statistics3

Canada

• Only 5% of borrowers are sub-prime.

United States

• Over 20% of borrowers are sub-prime.

Default rates

Canada4

• Overall default rates are less then 0.5%

United States

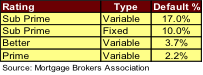

The following table summarizes the current sub-prime default rates in the United States:

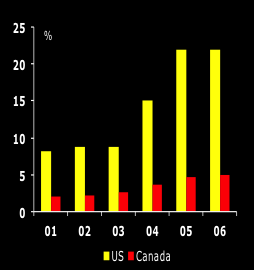

Figure 1.2.1: Canada versus US sub-prime lending

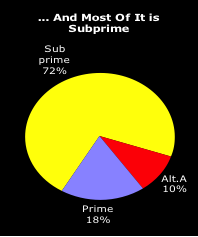

Figure 1.2.2: Sub-prime ratio of adjustable rate mortgages

Source: Bisson, Chris (2008), ‘Mortgage meltdown: Should we be worried?’ Housing Finance, University of Guelph Mortgage Centre

Early indications from the Mortgage Brokers Association show that US default rates vary based on whether the mortgage has a fixed or variable rate.

Figure 1.2.3: US sub-prime default rates: December 2007

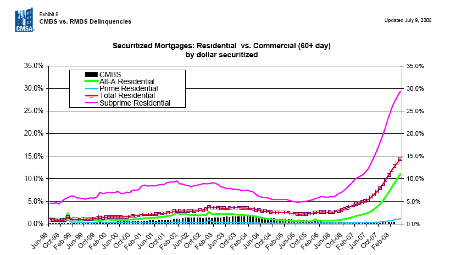

In July 2008, the Commercial Mortgage Securities Association compared delinquencies for US prime residential, sub-prime residential and commercial mortgage bonds to July 2008.

Figure 1.2.4 Securitized mortgages: residential vs commercial default rates

Residential markets

For residential markets, the focus of this article is on housing starts, sale activity, price trends and residential financing.

Non-residential markets

For non-residential markets, the focus of this article is on building permit activity, office and industrial markets, valuation parameters and non-residential financing.

RESIDENTIAL MARKETS

One measure of the performance of the residential market is housing starts. The second measure is prices of new house and resale homes.

Housing starts

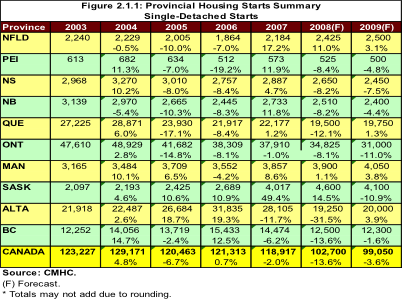

As per Figure 2.1.1: Provincial Housing Starts Summary – Single-Family Detached Housing Starts, for 2008, Canada Mortgage and Housing Corporation (CMHC) forecast single-family housing starts to decline in all provinces except Newfoundland, Manitoba and Saskatchewan. For 2009, only Newfoundland, Quebec and Manitoba will be exempted from forecast single-family housing start declines.

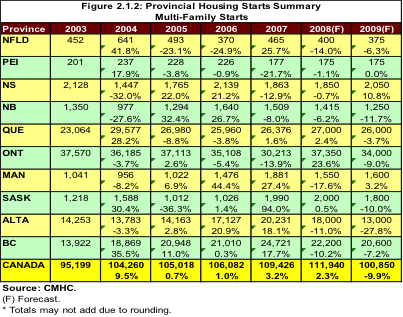

As per Figure 2.1.2: Provincial Housing Starts Summary – Multi-Family Housing Starts, for 2008, Canada Mortgage and Housing Corporation (CMHC) forecast multi-family housing (mostly condominiums) starts to decline in all provinces except Quebec, Ontario and Saskatchewan. For 2009, only PEI and Manitoba will be exempted from

forecast declines in multi-family housing starts.

Housing prices

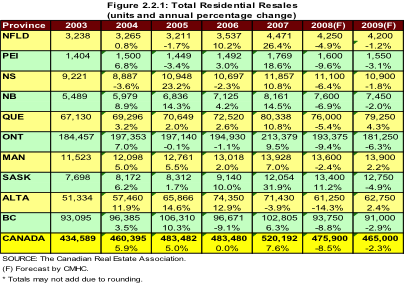

Figures 2.2.1 and 2.2.2 reflect CMHC forecasts of provincial residential resale activity and prices. As per Figure 2.2.1, total residential resale activity is expected to decline in all provinces except Saskatchewan.

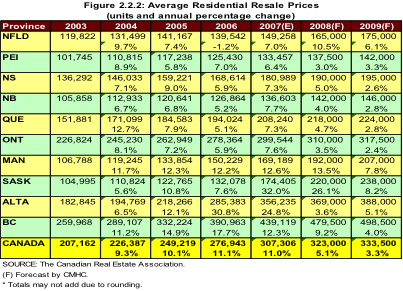

As illustrated in Figure 2.2.2, average residential resale prices increases will moderate. Only in Newfoundland and Manitoba are prices expected to increase from 2007 to 2008. Alberta’s average house prices are expected to increase from 3.6% in 2008 to 5.1% in 2009.

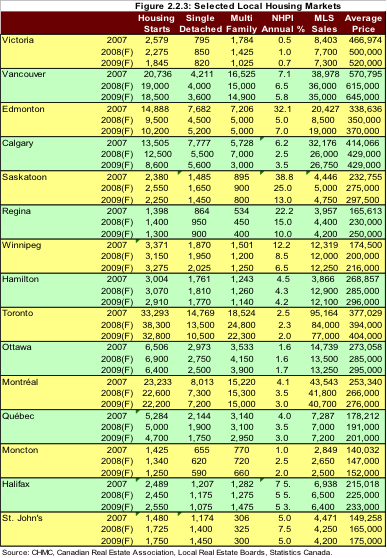

CMHC’s publication Housing Outlook Canada Edition Second Quarter 2008 details housing price forecasts for individual local markets as well. Figure 2.2.3: Selected Local Housing Markets summarizes forecasts for various Canadian cities to 2009.

Housing starts

Five cities stand out in terms of defying the overall trend to fewer housing starts in 2008 compared to 2007 – Regina, Toronto, Ottawa, Montreal and St John’s. In Regina, the increase in housing starts is attributable to expected increases in starts of single-family detached homes. In the other four cities, multi-family starts will offset declines in single-family detached homes starts.

House prices

Prices will increase in all markets from 2007 to 2008 and 2008 to 2009, except for Calgary which is expected to experience price stability.

Residential mortgage markets

On July 9, 2008, the federal government announced that CMHC would no longer insure 40-year mortgages with zero down payments. Quoting the July 11, 2008 Toronto Star article ‘Ottawa tightens mortgage rules:5

Concerned about the « risk of a U.S.-style housing bubble developing in Canada, » the federal government has tightened rules on government-backed mortgages, including limiting the use of popular, but controversial 40-year amortizations.

Longer-term rates of up to 35 years will still be allowed under new rules released yesterday, which are seen as a pre-emptive move to quell the kind of housing implosion in the United States not seen since the Great Depression.

« They are obviously quite concerned about what is happening in the United States, and the spillover into Canada, » said Jim Murphy, CEO of the Canadian Association of Accredited Mortgage Professionals. « The government is looking at their risk tolerance and the impact on Canadians. »

Murphy said 37% of all new Canadian mortgages taken from the one-year period ending in the fall of 2007 were longer than the standard 25-year amortization period.

« Longer-term mortgages have been extremely popular with Canadians, » said Murphy.

The new rules, which take effect October 15, would also require a minimum down payment of 5% on new government-backed mortgages and also call for « consistent » minimum credit-score requirements and loan-documentation standards. Under current rules, it is possible to take out a 40-year mortgage, which has been available on the market for less than two years, with zero down payment.

The regulations will apply to federal agencies such as the Canada Mortgage and Housing Corp., which has an estimated 60% share of the mortgage insurance market.

However, private-sector mortgage insurance rivals such as Genworth Financial, PMI Mortgage Insurance Co. Canada and AIG United Guaranty are free to offer the product.

One difference is that the federal government will no longer provide insurance that protects lenders in the event of a default by the insurers.

The new regulations mean potentially higher sales and prices in the near-term as « buyers jump into the market before they are enforced, » said TD Bank deputy chief economist Craig Alexander. « Then, the new rules will likely contribute to the cooling of the housing market. »

Interestingly, the Government of Canada action coincides with continuing instability in US Residential Secondary Mortgage Bond (RMBS) markets, with two government backed agencies Fannie Mae and Freddie Mac, which securitize the bulk of US residential mortgage loans through residential mortgage bond securities (RMBSs). In the US, banks are making fewer loans, and on tighter terms, while the securitization market is gone that formerly funded large loans, sub-prime loans and others.

Fannie and Freddie now fund eight out of every 10 loans in the US below the $417,000 level, according to regulatory data. By March 2008, Fannie and Freddie accounted for 97.6% of the mortgage bond market, compared with less than 50% in the first quarter of 2007, according to UBS.6

On July 13, 2008, the US Treasury and Federal Reserve took wide-ranging steps to boost Fannie Mae and Freddie Mac. Steps included a line of credit of $2.5 billion US and the Federal Reserve authorized borrowing from the discount window as necessary.7

The secondary mortgage market8 is the arena in which previously originated mortgage loans are bought and sold. It is critically important to the real estate industry as we know it today; not only do mortgage loan resales provide liquidity, but the requirements for marketability also strongly influence the types of loans lenders choose to originate.

In his July 12, 2008 article, ‘Good timing: Feds avoid Fannie-style mortgage freefall,’ Boyd Erman of the Globe and Mail stated that “the changes unveiled by Ottawa this week should help to avoid any danger of a similar, costly debacle in this country.

“The proof is in the performance of bonds issued by Canada Housing Trust, which plays the same role in this country as Fannie and Freddie do down south. Canada Housing Trust is the biggest issuer (besides governments) of bonds in the country and the backbone of Canada’s mortgage market.

“The trust’s Canada mortgage bonds are holding up fine. The spread between the interest rate on a CMB and a similar Canadian government bond has widened over the past year, thanks to the credit crunch. Yet, in the past month, as the outlook has become dire for Freddie and Fannie, the Canadian situation has been boring.

“Boring is good. Boring means Canada Housing Trust is able to continue selling bonds and buying mortgages.

“The mortgages behind RMBS in Canada are generally pretty good, i.e., they are insured and have bigger down payments and shorter amortizations than in the US. Also, because mortgage interest is not tax deductible in Canada, we tend to pay down home loans faster, adding to equity and credit quality.

“Until this week, the government was in danger of letting the Canada Mortgage Trust walk into the same trap as Fannie and Freddie, by allowing banks to dilute the quality of Canadian RMBS with more and more dodgy home loans.” 9

By October 2008, further uncertainty led to a decision by the Government of Canada to try to unfreeze credit, by arranging for a program to buy residential mortgages from lending institutions.

Canada Mortgage and Housing Corp plans to buy up to $7-billion of mortgages from Canadian lenders on October 23. That will be the second wave of purchases under the government’s new $25-billion program, designed to help banks and other lenders with financing that will make it easier for them to lend to consumers. The first $5-billion purchase was done at a price that suggests Ottawa could earn roughly $250-million from the $25-billion program. Banks have welcomed the new measure, and many are calling for it to be increased. The government is using its ability to borrow cheaply to provide the banks with cheaper financing for their mortgage portfolios than they could raise themselves.10

INVESTMENT PROPERTY MARKETS

Non-residential building permits

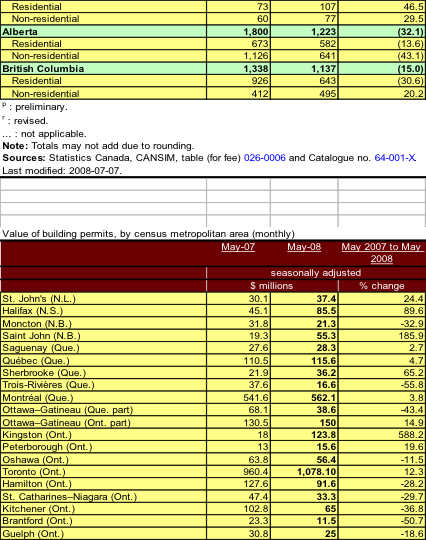

Figure 3.1: Value of permits by province, summarizes the value of both residential and non-residential building permits by province for May 2007 and May 2008. Note that declines in non-residential building permits have outstripped those in residential. Exceptions to the decline in non-residential are Newfoundland, PEI, New Brunswick, Ontario, Saskatchewan and BC.

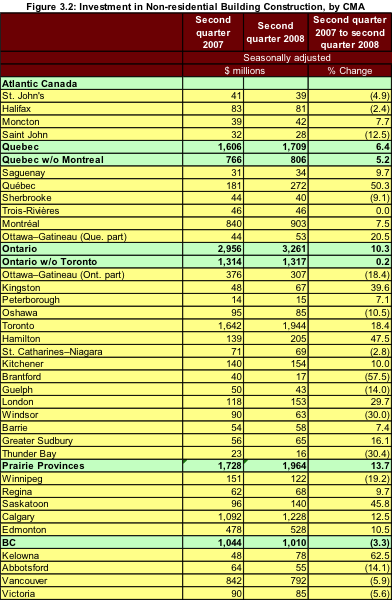

Figure 3.2: Value of non-residential permits by CMA, summarizes the value of both residential and non-residential building permits by CMA for May 2007 and May 2008. Here, the pattern is much more complex, with some cities showing ongoing expansion, while other locations (e.g., Ontario) have shown dramatic declines. This type of bifurcation in the market is caused by local factors, such as layoffs in manufacturing.

Non-residential construction declined in all centres in Atlantic Canada, except Moncton. In Quebec, Sherbrooke saw a decline in non-residential construction. Certain centres in Ontario were hit with declines, especially Ottawa, Oshawa, St. Catharines-Niagara, Brantford, Guelph, London, Windsor and Thunder Bay. In the prairie provinces, Winnipeg suffered from decreases in non-residential construction. In BC, only Kelowna was exempted from a decline in non-residential construction

Office and industrial markets

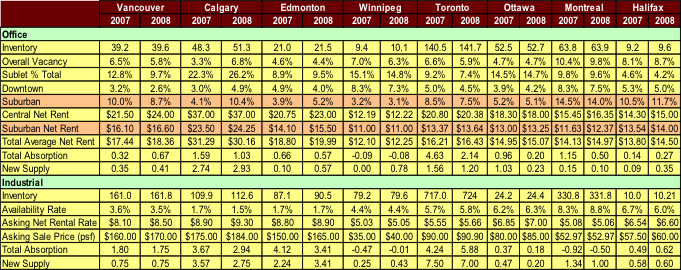

CB Richard Ellis 2008 Canada Market Outlook summarized its expectations for the major Canadian markets for 2008 as follows:

Office markets

For downtown office markets, the expectations are buoyant, with most markets except Toronto and Ottawa indicating decreases in vacancy and increasing rents.

For suburban office markets, the expectations are less optimistic, with Vancouver, Winnipeg, Toronto, Ottawa and Montreal indicating decreases in vacancy, while Calgary, Edmonton and Halifax should see increasing vacancy.

For suburban office markets, rents are expected to increase in Vancouver, Calgary, Edmonton, Toronto, Montreal and Halifax, while remaining stable in Winnipeg.

Industrial markets

For industrial markets, availability is expected to decrease in Vancouver, Calgary and Halifax, remain stable in Edmonton and Winnipeg, and increase in Toronto, Ottawa and Montreal. Rents and prices are likely to rise in Vancouver, Calgary, Edmonton, Winnipeg, Toronto, Ottawa and Halifax. In Montreal, rents and prices are expected to remain stable

Commercial and industrial valuation parameters

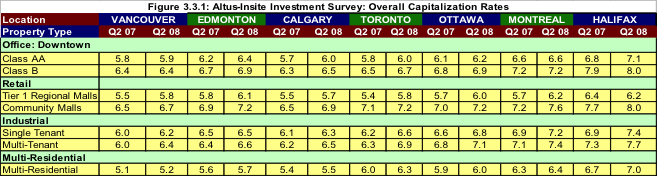

Figure 3.3.1: Altus-Insite Investment Survey Overall Capitalization Rates (OCRs) summarizes the effect of the sub-prime crisis dramatically. Generally, OCRs have risen 1-4 basis points in most categories including office, retail, industrial and multi-residential markets surveyed across Canada.

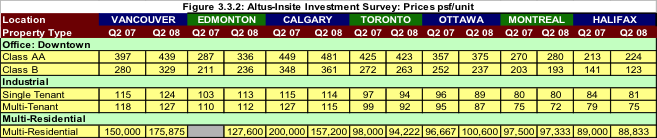

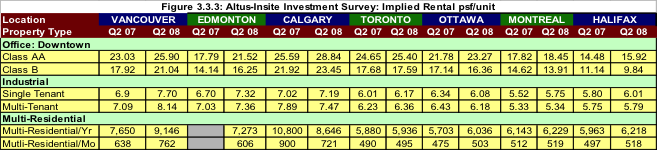

Interestingly, Figure 3.3.2: Altus-Insite Investment Survey of Prices per Square Foot/Unit illustrates that the upward trending OCRs have not necessarily affected prices in all locations. If rents have trended upwards, this may have offset the change in OCRs.

Figure 3.3.3: Altus-Insite Investment Survey Implied Rents Psf/Unit shows that dramatic increases in rents in Vancouver, Edmonton and Calgary have more than offset the upward trending OCRs for both downtown class AA and class B offices. This upward trending rental effect is limited to downtown class AA in Montreal and Halifax, whereas downtown class B rents decreased. This demonstrates the important interaction of rents and capitalization rates in different types of real estate and locations.

Commercial mortgage markets

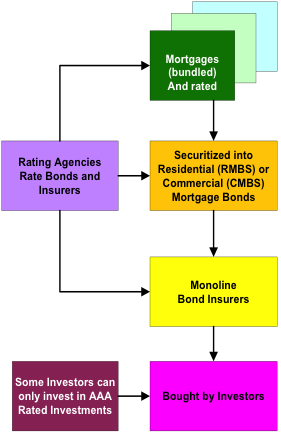

Commercial mortgage-backed securities (CMBS) are bonds created by pooling a group of commercial mortgages and issuing bonds against the security of the underlying properties. The security of the bond is comprised of income producing properties such as commercial and industrial buildings, multi-family units, retail and office spaces. Specific properties are secured against overall debt and subordination of the various tranches can change a tranche’s credit rating from AAA to BBB. This is referred to as the waterfall concept. CMBSs are structured to pay investors monthly income consisting of principal and interest for the first tranche rate AAA, and interest only for subsequent tranches. Principal on a CMBS issue’s tranches is paid subsequently in order of class. The class A tranche pays principal out fully before the class B tranche receives any principal payments and class C will receive principal payments only after class B is fully paid out11. An outline of how the mortgage securitization process functions is outlined in Figure 3.4.1 Mortgage Securitization Process.

In Canada, the success of the residential secondary mortgage market has led to the development of a commercial secondary mortgage market. The pioneers in this market were CIBC and Merrill Lynch, but other firms such as TD Bank, Royal Bank and Scotia McLeod (Bank of Nova Scotia) followed.

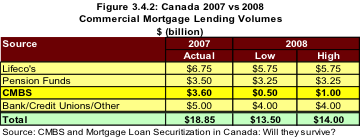

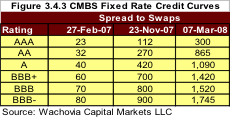

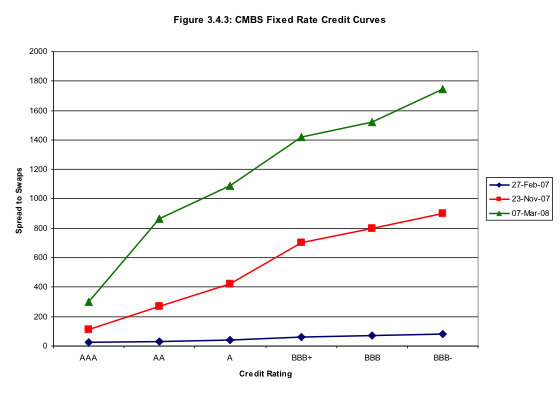

One notable effect of the sub-prime crisis was the effect on commercial mortgage bond securities (CMBS). In Canada, the effects included the meltdown in the asset-backed commercial paper (ABCP) market as well. At the Real Capital Forum, held in February 2008, David Miller, President of Canadian Mortgage Rating Service Ltd., addressed the question: ‘CMBS and mortgage loan securitization in Canada: will they survive?’ In Figure 3.4.2 Canada 2007 vs 2008 Commercial Mortgage Lending Volumes12, indications are that commercial lending volumes will decrease dramatically in 2008.

This would have a damping effect on commercial property transactions. An article entitled CMBS Market Correction and Commercial Property Valuations13 suggests property value decreases by 2.2% for a generic property and 3.1% for a premium property. Moderating income growth forecasts by half could further lower valuations by 5.8% for a generic property and 14.5% for a premium property.

Figure 3.4.1 Secondary Mortgage Market Chart

According to Mr. Plessl of RBC Dominion, “Canada’s $15-billion a year commercial mortgage lending industry has gone from a period of excess supply into a relative drought – one that could leave the market $3-billion to $4-billion short of what borrowers are seeking in 2008.

“Borrowers who do manage to find a loan that suits their purposes should grab it as quickly and as early in the year as possible, as there is a good chance banks will run out of funds allocated for commercial mortgages around August,

“The primary issue is fallout from the global credit crisis, which has put a halt to one of the industry’s key sources of financing, commercial mortgage-backed securities (CMBS). A form of bond comprised of commercial mortgage loans that are packaged and sold to investors, CMBS issuance went from $200-million in 1998 to $4.8-billion in 2006.

“That came to an abrupt halt late last year, when defaults on sub-prime mortgages in the US spilled over to cause a deep freeze on investor demand for asset-backed debt products.” As illustrated in Figure 3.3.3, CMBS spreads to swaps have increased significantly from February 2007 to March 2008.

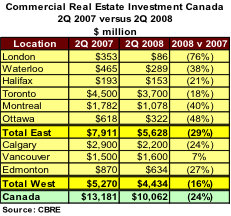

Commercial real estate investment market

On August 27, 2008, CBRE forecast that commercial real estate in Canada would fall by as much as 40% in 2008. CBRE compared commercial investment transactions the second quarter of 2008 to the second quarter of 2007. The following table illustrates the results of the survey. Only Vancouver experienced an increase in market activity. All other major Canadian cities experienced declines. The overall decline in commercial real estate investment in Canada was 24%.

Figure 3.5.1. Commercial Real Estate Investment Market

SPECIFIC TRANSACTIONS

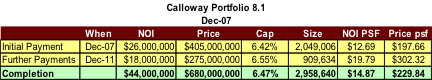

One transaction exemplifies the more difficult market brought about by financing issues. The acquisition by Calloway REIT was originally announced on December 2007 and was to consist of 10 properties with a capitalization rate of 6.42%, totaling 2,049,006 sq. ft. for completed projects and a further component for 909,634 sq. ft. of projects under development at a 6.55% capitalization rate, for an overall rate of 6.47%.

Figure 4.1: Calloway Portfolio Sale Announced Dec-2007

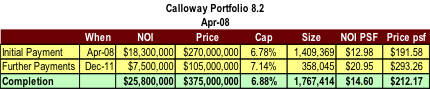

A revised press release in April 2008 reduced the number of properties to six, with a capitalization rate of 6.78% for developed properties totaling 1,409,369 and a further component for 358,045 sq. ft. of projects under development at a 7.14% capitalization rate for an overall rate of 6.88%. Both the price and the financing arrangements had changed. Properties in Hamilton, Pembroke, Laval and Winnipeg were excluded.

Figure 4.2: Revised Calloway Portfolio Sale Announced April 2008

CONCLUSIONS

Overview

Canada’s real estate markets have been affected by the US sub-prime crisis, both directly thorough the tightening of credit and lending and indirectly through the resultant economic slowdown in the housing markets. Industries such as lumber have been affected. Indeed, it could be said that the decline in the US dollar and resultant exchange rates are due in large part to the sub-prime fiasco. The effects are by no means completed, because the political and economic consequences will reverberate throughout the US until the results of the November 2008 presidential and congressional elections are known.

In the meantime the full effect of the sub-prime crisis on Canada is still undetermined as we approach the end of 2008. The effects will continue through 2009 at a minimum.

Residential markets

In 2008, residential market activity will slow down in all provinces except Saskatchewan. Price increases will moderate in all provinces except Newfoundland and Manitoba. In terms of local markets, price increases will continue to increase, but at a more moderate level than in 2007. In terms of residential mortgage financing, the federal government decision to discontinue CMHC insurance for 40-year amortization mortgages and zero financing will contribute to cooling the housing market.

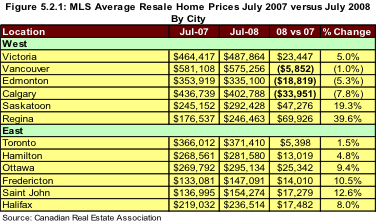

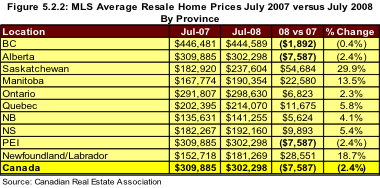

By August 2008, Canada’s housing market showed fresh signs it has exited the boom phase. A Canadian Real Estate Association report showed sales activity slumped 13.1% in the first half of the year. Resale home prices decreased by 2.4% between July 2007 and July 2008.

Western Canada led the year-on-year decline in prices, with Vancouver, Edmonton and Calgary affected. In contrast, Saskatoon and Regina have continued to benefit from significant price increases.

Eastern Canadian cities, especially Toronto and Hamilton, have experienced more moderate increases from prior years. Ottawa, a notable exception, is still benefiting from government-induced local growth.

Investment property markets

The decline in availability of commercial mortgage funds and upward trending capitalization rates will contribute to moderating of prices in most major markets. This will be offset by increasing rents especially for downtown class AA office space. Downtown class B office and suburban office space demand will moderate in most locations.

Industrial availability will generally remain low and rent increases will be moderate, except in high demand locations such as Vancouver, Edmonton and Calgary.

In conclusion, Canadian markets are bifurcated by a combination of local real estate market conditions and economic factors. That said, most markets will experience some moderating trends due to the sub-prime crisis and related factors in 2008 and 2009.

According to CB Richard Ellis Ltd, commercial real estate investment in Canada is forecast to fall by as much as 40% or more this year, the biggest drop since the start of the decade17.

Economic uncertainty and hesitation by investors, a reduction in availability of financing and a smaller pool of properties mean a challenging market for commercial sales in 2008.

While residential real estate nationally has suffered a decline in sales, the commercial world has been taking an even worse hit, reflecting the global slump in property markets.

Kim Mercado, manager of national research for CB Richard Ellis, said some buyers are taking a « wait and see approach » to determine where the market is going for commercial deals, which include all office, apartment, industrial and retail properties.

Mercado is quick to point out that 2007 was a record year, with three significant real estate investment trust transactions, including the sale of Legacy REIT, the largest hotel and lodging trust, for $2.5 billion, helping to push sales 33% higher than the previous year.

That is not happening this year. In the first six months of the year, investment in commercial real estate by both foreign and domestic buyers was already showing a steep decline, falling 24% to $10 billion from the same period in 2007.

Of the nine major markets covered in the study, only Vancouver had a slight increase, rising from $1.5 billion last year to $1.6 billion in the first half of this year for a 6.6% increase.

Already, other indications from analysts at the Urban Land Institute and PricewaterhouseCoopers LLP18 indicate that “the Canadian commercial real estate market will be hit by shockwaves emanating from the economic crisis in the US next year, according to a report by the Urban Land Institute and PricewaterhouseCoopers LLP.

However, in 2009, the Canadian market is more likely to be in for a tough slog rather than the full-blown disaster unfolding in the US, according to the report, which included feedback from more than 700 industry members.

“Overall, Canada may get sideswiped, but should avoid the more serious problems suffered south of its border,” the report said.

Upward pressure on capitalization rates may be expected in the next 12 months. The credit crisis is affecting the value of commercial real estate, according to Desjardins Securities analyst Jeff Roberts. Mr. Roberts has raised the capitalization rates he uses to value real estate investment trusts and real estate operating companies.

“The financial crisis over the last month has and will cause real estate cap rates to increase significantly, we believe, despite the scarcity of transaction activity,” said Mr. Roberts, adding pricing from deals that closed even as late September do not reflect the current marketplace. He estimates cap rates have risen 50 to 100 basis points since early October19.

US developments and expected affect on Canada

Henry Paulson, the US Treasury Secretary, turned to Canada and other Group of Seven industrialized countries on September 21, 2008 to back a sweeping financial relief package to alleviate stresses in the banking system that carries a fast-rising price tag of well over US $700-billion to buy up the bad debt associated with the sub-prime crisis20.

Given that the US Federal Reserve and US Treasury had already committed $380 billion in previous attempts to calm the troubled financial markets for a cumulative investment of over $1 trillion US dollars to date, some commentators were calling the latest effort, “Resolution Trust Two,” reminiscent of the process used to overcome the problems caused by the US Savings and Loan crisis in the 1980s.

The ongoing effects of the sub-prime debt led to US government takeovers of Fannie Mae and Freddie Mac, the main holders of troubled RMBS paper, and AIG Insurance, an insurer of collateralized debt securities. In addition, the investment banks Lehman Brothers declared bankruptcy and Merrill Lynch was taken over by the Bank of America.

By September 22, 2008, the last two standalone investment banks on Wall Street surrendered their independence, as Goldman Sachs and Morgan Stanley agreed to transform themselves into holding companies and accept much tighter regulation in a deal that limits their ability to take risks and reshapes international finance.

The decision to fundamentally transform Wall Street to look more like Canada’s Bay Street, where investment banks operate under the wing of commercial banks, reflects the growing acceptance by regulators that the independent model has created too much risk in the financial system.

The move will be welcomed by Canadian banks that sought greater clarity from US regulators over the way the industry would be governed in the future, after investment banks were forced to break the rules and seek emergency funds from the Federal Reserve to survive amid the credit crisis.

The decision to place the institutions under Fed supervision and reduce the amount of leverage they can risk for every dollar they hold creates a more level playing field for Canadian and other commercial banks21.

End Notes

1 FICO is a credit score developed by Fair Isaac & Co. It is used by many mortgage lenders that use a risk-based system to determine the possibility that the borrower may default on financial obligations to the mortgage lender. Equifax and Fair Isaac use this system. TransUnion and Experian, also sell their scores to consumers. TransUnion’s credit score ranges from 300 to 900. Experian calls its credit score product PLUS Score. The PLUS Score ranges from 330 to 830.

2 Financial Consumer Agency of Canada (2007), ‘Understanding Your Credit Report and Credit Score’

3 Canadian Association of Accredited Mortgage Brokers

4 Canadian Association of Accredited Mortgage Brokers, March 2007

5 Wong, Tony, Trichur, Rita and Daw, James (2008), ‘Ottawa tightens mortgage rules,’ Toronto Star, July 10, 2008

6 Saft, James (2008), ‘The indispensability of Fannie and Freddie,’ Reuters, July 11, 2008

7 Murray, Brendan and Kopecki, Dawn (2008), ‘Mortgage giants shored up,’ Toronto Star, July 14, 2008

8 These are known as collateral loans versus equity loans. Collateral lending was heavily promoted in the US as a means of financing new cars, furniture, home renovation, and vacations. The key in collateral lending is the ability of the loan recipient to make payments. We have not had the same traditional of collateral lending in Canada, again because our lenders are more cautious.

9 Erman, Bart (2008), ‘Good timing: Feds avoid Fannie-style mortgage freefall,’ Globe and Mail, July 12, 2008.

10 Perkons, Tara, October 2008, ‘CMHC to buy $7-billion of mortgages,’ Globe and Mail, October 21, 2008

11 Cira, Mary Associate Director CIBC Portfolio Advisory Group (Summer 2002), Fixed Income Product Focus – commercial mortgage-backed securities (CMBS)

12 Miller, David (February 2008), Real Capital Forum – Toronto, ‘CMBS and mortgage loan securitization in Canada: will they survive?’

13 Barve, N, Bryson, A and Jin, Wei (2008), CMBS World, ‘CMBS Market Correction and Commercial Property Valuations.’

14 McLeod, Lori (2008), ‘Commercial mortgage market faces shortfall,’ Globe and Mail, January 30, 2008.

15 Wong, Tony (2008), ‘Commercial property sales in steep drop,’ Toronto Star, August 27, 2008

16 Grant, Tavia, (2008), ‘Housing slump stalks Western Canada,’ Globe and Mail, August 8, 2008

17 Wong, Tony, (2008), ‘Commercial real estate projected to tumble,’ Toronto Star, August 8, 2008

18 Mcleod, Lori (2008), ‘Commercial real estate faces pinch,’ Globe and Mail, October 21, 2008

19 Ratner, Jonathan, (2008), ‘Higher cap rates bad news for REITs,’ Financial Post, October 21, 2008

20 Callan, Eoin, ‘Fed allows Goldman, Morgan to become bank holding companies,’ National Post, September 22, 2008

21 Ibid

References

Altus-Insite, (Q2 2007 and Q2 2008), Altus-Insite Investment Survey

Barve, N., Bryson, A., and Jin, Wei (2008), CMBS World, ‘CMBS Market Correction and Commercial Property Valuations’

Bisson, Chris (2008), ‘Mortgage Meltdown – Should we be worried?’ Housing Finance, University of Guelph Mortgage Centre

Callan, Eoin, ‘Fed allows Goldman, Morgan to become bank holding companies,’

National Post, September 22, 2008.

Calloway REIT (2007), Press Release, December 2007

Calloway REIT (2008), Press Release, April 2007

Canadian Association of Accredited Mortgage Brokers, (March 2007)

Canadian Real Estate Association (2008), ‘Average Local House Prices’

CB Richard Ellis (2008), Canada Market Outlook 2008

CMHC (2008), Housing Outlook Canada Edition Second Quarter 2008

Cira, Mary Associate Director CIBC Portfolio Advisory Group (Summer 2002), ‘Fixed Income Product Focus – Commercial Mortgage Backed Securities (CMBS)’

Erman, Bart (2008), ‘Good timing: Feds avoid Fannie-style mortgage freefall,’ Globe and Mail, July 12, 2008

Financial Consumer Agency of Canada (2007), ‘Understanding Your Credit Report and Credit Score’

Grant, Tavia, (2008), ‘Housing slump stalks Western Canada,’ Globe and Mail, August 8, 2008

McLeod, Lori (2008), ‘Commercial mortgage market faces shortfall,’ Globe and Mail, January 30, 2008

McLeod, Lori and Carmichael, Kevin (2008), ‘Ottawa tightens mortgage rules to avoid ‘bubble,” Globe and Mail, July 9, 2008.

Mcleod, Lori (2008), ‘Commercial real estate faces pinch,’ Globe and Mail, Oct. 21, ‘08

Murray, Brendan and Kopecki, Dawn (2008), ‘Mortgage giants shored up,’ Toronto Star, July 14, 2008.

Miller, David (February 2008), Real Capital Forum – Toronto, ‘CMBS and Mortgage Loan Securitization in Canada: Will they survive?’

Perkons, Tara, (2008), ‘CMHC to buy $7-billion of mortgages,’ Globe and Mail, October 21, 2008

Ratner, Jonathan, (2008), ‘Higher cap rates bad news for REITs,’ Financial Post, October 21, 2008

Saft, James (2008), ‘The indispensability of Fannie and Freddie,’ Reuters, July 11, 2008

Statistics Canada (2008), Non-Residential Building Permits (Monthly), May 2008.

Wong, Tony, Trichur, Rita and Daw, James (2008), ‘Ottawa tightens mortgage rules,’ Toronto Star, July 10, 2008.

Wong, Tony, (2008), ‘Commercial real estate projected to tumble,’ Toronto Star, August 8, 2008